We’re thrilled to share that our Chief Strategy Officer, Raffael Maio, has been featured in a recent article “5 signs your loved one is a money mule” by Which?, a highly reputable and recognized UK consumers association. The article discusses into the critical issue of money mules and fraud prevention, highlighting the evolving tactics of fraudsters and the measures being implemented to combat these threats.

5 signs your loved one is a money mule

This article was first published on June 26, 2024, on Which? website.

By Chiara Cavaglieri

Money mules are a crucial link in the fraud chain – and, while they are criminals in the eyes of the law, many are completely unaware of their involvement. You may know one, or even be one yourself.

Mule accounts are used to shift around £10bn per year of fraudulently obtained cash in the UK, according to the National Crime Agency (NCA).

So what exactly is a money mule, and what are the warning signs that someone you care about has been recruited?

What is a money mule?

Put simply, a money mule lets someone else use their bank account to transfer illicit cash. This dirty money is often gained via horrifying operations, from online fraud and drug-dealing to human trafficking.

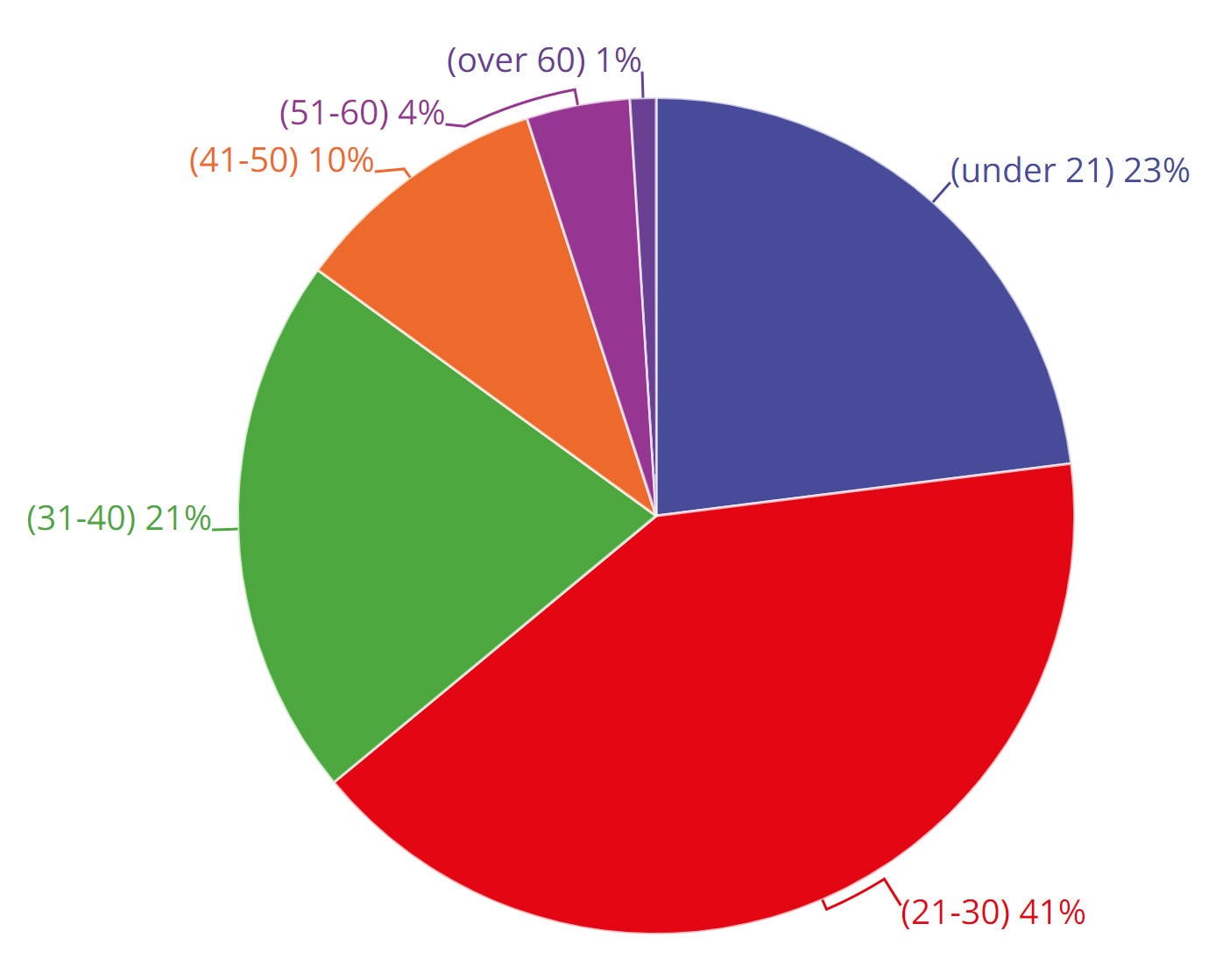

Nearly two thirds of bank accounts indicating mule behaviour in 2023 belonged to people aged under 30, according to fraud prevention agency Cifas.

However, criminal gangs also target older people because they’ve usually held their bank accounts for many years and are less likely to arouse suspicion.

Money mules by age

Long-lasting implications

Not all money mules are complicit – many are victims of fraud themselves, while others may be forced or tricked into letting criminals use their bank accounts – and one in five adults aren’t aware muling is illegal.

But the implications of becoming embroiled in money laundering are severe, with perpetrators facing prison sentences of up to 14 years.

Banks and law enforcement take into account whether someone was tricked into becoming a money mule when deciding how to deal with a case. However, even unwitting victims could have their accounts closed and face years of difficulties accessing credit, from mortgages to mobile phone plans.

This is because banks may record a marker against their name on the Cifas National Fraud Database, which is checked by hundreds of other banks, insurers and telecoms companies. This marker will last for six years unless successfully challenged.

Offers of quick and easy cash

When it comes to enlisting potential mules, recruiters or ‘herders’ target young people and desperate job hunters with offers of ‘easy money’ to work from home.

They may recruit in person or advertise in local papers and online, using phishing emails and social media platforms such as Facebook, Instagram, Snapchat and X (formerly known as Twitter). Their only requirement is a UK bank account.

Key phrases to watch out for include ‘flip money’, ‘instant cash’, brand-specific hashtags like #PayPalFlip, and job titles such as ‘money transfer agent’, ‘local processor’ or ‘transactions analyst’.

Once recruited, the mule receives funds into their account and either withdraws it or sends it on to another account, taking a cut as ‘commission’.

Romance is dead

A sinister evolution in some romance frauds is to manipulate victims into becoming money mules.

Perpetrators create fake online identities and target people on dating websites, social media and even gaming platforms.

They try to establish an emotional connection quickly before asking for money or gifts, perhaps claiming they have urgent bills to pay, travel and visa costs, or medical treatment to cover.

The worst will also turn their victims into money mules, either by asking for direct access to their accounts or convincing them to send money as a favour. Which? is aware of cases where romance fraudsters pretended they had problems with their own bank account, or asked victims to let them transfer funds into crypto exchanges for ‘tax breaks’.

Emerging money mule tactics

Fraudsters are becoming ever more sophisticated.

Advances in artificial intelligence (AI) have sparked a rise in ‘deepfakes’ (doctored videos and audio), which has helped romance scammers appear on camera to reassure victims.

Other evolving trends include impersonating bank fraud teams or other officials to trick people into opening new bank accounts. Younger people may be given gift cards to buy electronic devices, which criminals resell on online marketplaces.

Europol recently reported that vulnerable migrants fleeing war zones such as Ukraine are also being forced to open bank accounts for money laundering.

Meanwhile, Cifas says there’s been an increased use of AI to create fake identities, enabling criminals to bypass security checks when they open bank accounts. After all, why take the risk of recruiting real individuals to move your dirty money when you can use a fake identity and move it yourself?

5 signs your loved one is a money mule

- They suddenly have extra cash and expensive new clothes or extravagant goods such as flashy gadgets, with little explanation as to how they got the money.

- They open a new bank account or cryptocurrency wallet that they can’t adequately explain – or which they seem cagey about when you ask them for more details.

- They have a vague new job, or are involved in a money-making scheme. Criminals recruit mules via social media with no requirement other than having a bank account.

- They have a new relationship with someone they’ve only met online. Romance scammers build trust before asking victims to move money on their behalf.

- They’ve become more secretive or stressed. People can be exploited into becoming a money mule – even by family, friends or members of their own community.

If you suspect someone of attempting to recruit mules, do not contact them. Report money muling to local police on 101, or contact Crimestoppers anonymously on 0800 555111.

Firms named and shamed by regulators

Major banks have given the public little reason to trust that they’ve got the problem of money laundering under control.

In December 2021, NatWest was fined £265m after pleading guilty to charges of anti-money laundering (AML) failings. It was the first time the Financial Conduct Authority (FCA) had pursued criminal prosecution under the UK’s money laundering regulations.

Flexing its regulatory muscles rather than going via the courts, the FCA issued a £64m fine to HSBC just a week later. This was followed in December 2022 by a £108m fine for Santander, and £4m for Al Rayan Bank in January 2023.

Where is the cash going?

In another industry first, in October 2023 the Payment Systems Regulator (PSR) published detailed data about authorised push payments (APP) – when someone is tricked into sending money to a fraudster posing as a genuine payee.

It named the worst firms for receiving fraudulently obtained cash, revealing those with weaknesses – including poor detection of mule accounts – that had been exploited at scale by criminals.

It showed an alarming gulf in the levels of exposure to APP fraud across the industry, with smaller payment firms receiving disproportionately higher rates of cash from APP fraud than larger, more established banks.

The two worst firms, Clear Junction and BCB Payments, offer services to other financial institutions (not to individual consumers).

Of those that do offer services to consumers, Cashplus Bank (which offers business accounts), PrePay Technologies (the e-money firm behind Monese), Revolut and Wise (a foreign transfer app) were all far more exposed than even the worst of the big banks (Metro Bank and TSB).

Firms will be liable for fraud that they process

The good news is that banks and payment firms have a new financial incentive to tackle fraud, thanks to a mandatory reimbursement scheme for APP fraud that comes into force on 7 October 2024.

Once implemented, all firms using Faster Payments will be liable to compensate customers for fraud losses up to a maximum of £415,000, subject to customers meeting certain standards. Crucially, both sending and receiving firms will split the costs of reimbursement 50:50, although they can make the victim pay a £100 excess per claim (unless they are considered vulnerable).

The payments industry is currently lobbying to delay the new scheme by a year and reduce the cap to as little as £30,000. Which? is urging the regulator and ministers to resist calls to slash the cap and press ahead with the current schedule to ensure the public benefits from fairer and more consistent treatment if they fall victim to fraud.

The future of money mule detection

New tech is making it easier for firms to limit their exposure to fraud – for example, AI risk models mean that every customer has their own ‘rules’ and this granularity of detail significantly strengthens mule detection.

But Raffael Maio of NetGuardians, a software company that partners with major financial institutions, says this isn’t enough – not least because some banks are being too slow in integrating new, more sophisticated systems.

‘It’s quite accurate to say the UK is the money-laundering capital of Europe. Technology helps the banks defend themselves, but it also helps the fraudsters perpetuate crime at a global scale much faster,’ he says.

An industry processing billions of payments every year must work together, sharing information about suspicious activity and using the best tools available to spot and stop fraud. But it remains to be seen whether they will win this particular arms race.