Award-winning technology 3D Artificial Intelligence (3D AI)

Anomaly detection (unsupervised learning)

Fraud recognition (supervised learning)

Adaptive feedback (active learning)

Anomaly detection (unsupervised learning)

Fraud recognition (supervised learning)

Adaptive feedback (active learning)

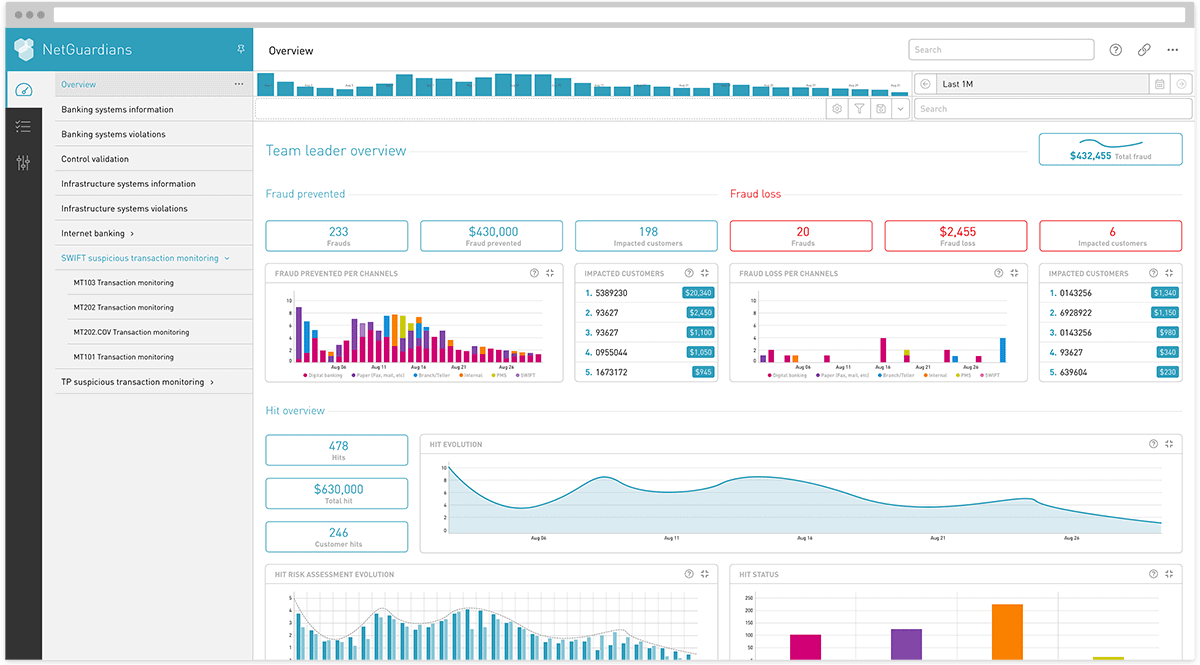

Example of a team leader overview dashboard

Selected timeframe

Fraud mitigation performance

Total amount of prevented frauds

Impacted customers – Number of customers saved from being a fraud victim

Total number of hits

NetGuardians’ software is specifically designed to help banks detect and prevent fraud. Plugging directly into core banking systems via pre-defined connectors, it extracts, enriches and analyzes data, spotting and stopping significantly more fraud and reducing investigation time.

Beating Banking Fraud with NetGuardians’ Machine Learning Risk Platform

You don’t need to be a data scientist to make sense of AI algorithms. Easily understand why AI raises an alert with the full business context and run powerful forensics using intuitive investigation tools.

NetGuardians’ CTO Jérôme Kehrli explains how AI helps financial institutions to prevent banking fraud.

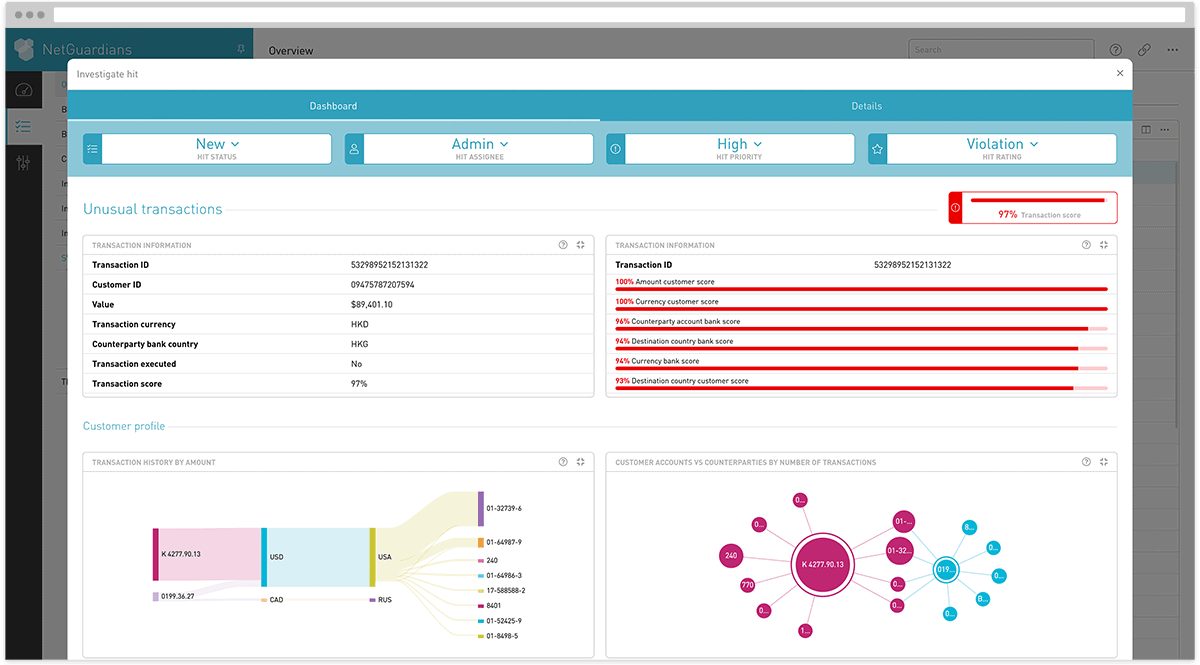

Transaction score – Highlights the global risk score of the transaction

Transaction information – All important information of the transaction

Transaction score details – Unusual variables that lead to the blocking of the transaction

Within the millions of transactions a bank processes each year there will be a small number of frauds. While traditional AI systems can be taught to spot these frauds, they will become experts only in these known frauds – overfitting. NetGuardians’ managed learning technology doesn’t endlessly learn about any given type of fraud. It prevents AI from continually diving down just a few avenues. This avoids overfitting and makes it smarter and more dynamic, able to spot new types of fraud.

How to overcome overfitting in machine learning based fraud mitigation for banks?

A roadmap for applying AI models to prevent banking fraud.