Intelligently prevent fraud and detect money laundering risks.

Protect your customers.

Build trust.

Grow your business.

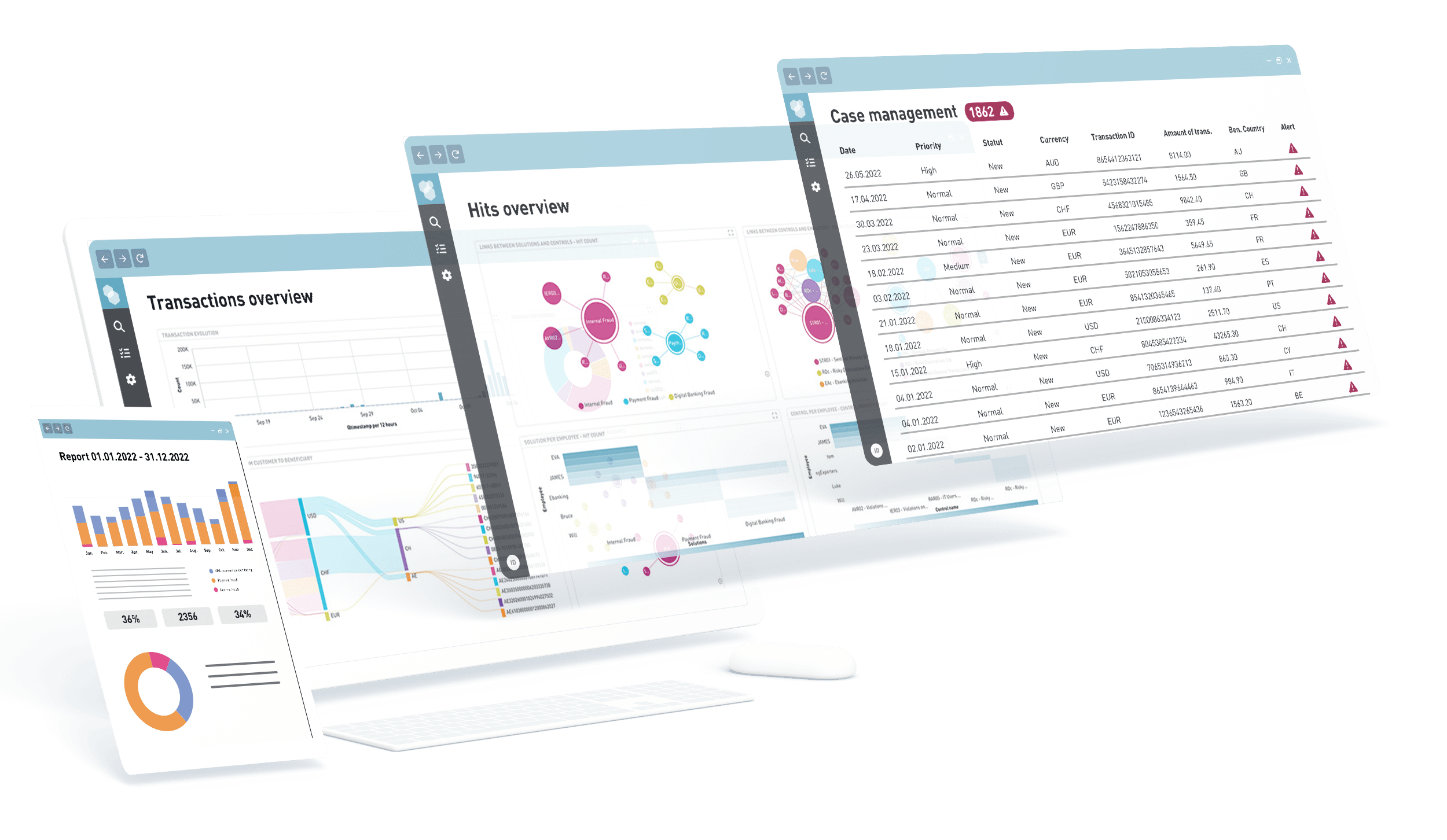

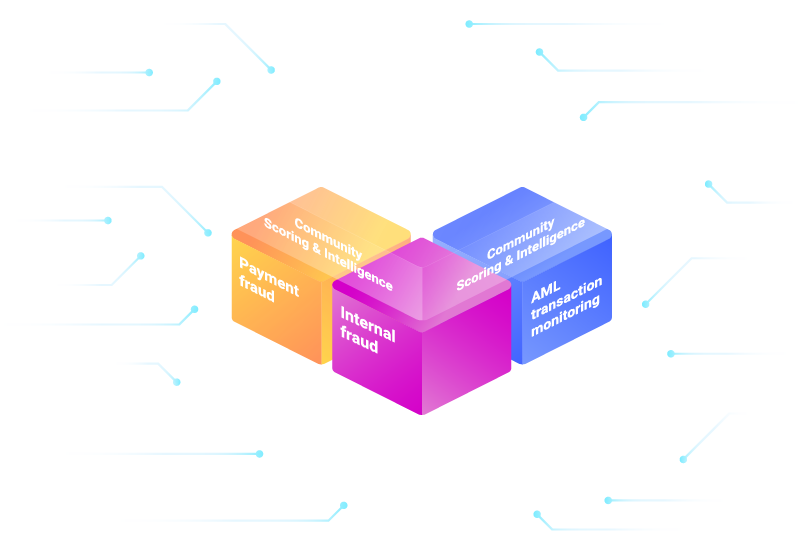

Instantly and accurately block fraudulent transactions resulting from account takeover and social engineering scams.

Prevent internal banking fraud due to internal and external collusion, controls bypass and more.

Identify potentially suspicious transactions and risky customer behaviour while intelligently lowering false positive rates.