Fraudsters are getting smarter and more coordinated, making it tougher for financial institutions to stay ahead. Scams are especially hard to detect, and criminals are using more and more banks accounts as money mules for illicit money transfers. But criminals often reuse beneficiary accounts, which may have already been used to defraud others….

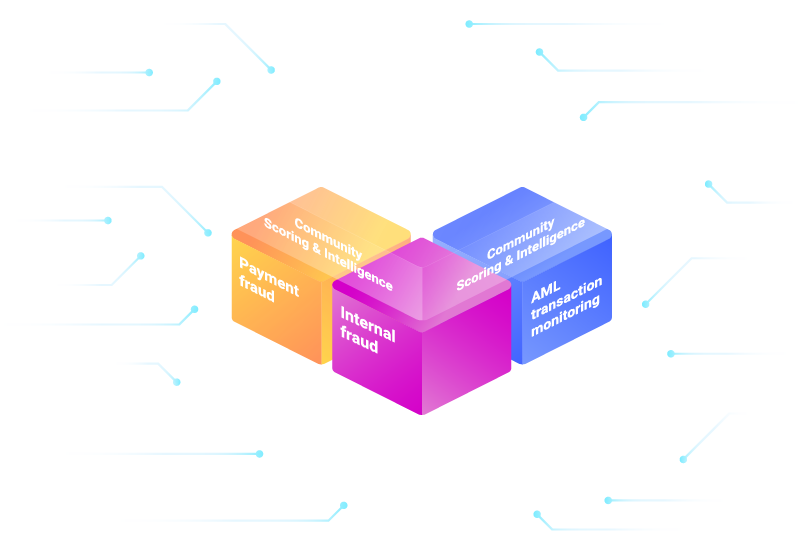

Here’s where the strength of community lies. By leveraging collective intelligence through NetGuardians’ CS&I, you can share and receive insights on financial crime activities to better detect fraudulent transactions and to identify money mule beneficiaries.

Please note that this solution is currently available in Switzerland. We’re building an equivalent initiative in Kenya.